In the complex world of financial services, credit scores stand as a pivotal element in a bank’s decision-making process. Understanding these scores is crucial for both consumers and financial institutions. This comprehensive guide aims to unravel the intricacies of credit scores from a bank’s viewpoint, illuminating the path for better financial decisions and healthier bank-client relationships.

1. The Essence of Credit Scores

In simple terms, a credit score is a numerical representation of an individual’s creditworthiness. Banks and lenders use this score to evaluate the risk of lending money. Higher scores indicate lower risk and vice versa. But what factors contribute to this score? Typically, credit bureaus consider elements like payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries.

2. The Role of Credit Bureaus

Credit bureaus play a vital role in the financial ecosystem. These independent organizations collect and maintain individual credit information, providing a basis for credit scores. The most prominent bureaus — Experian, Equifax, and TransUnion — each have their unique algorithms for calculating credit scores. Understanding their methodologies can be a game-changer for anyone looking to improve their credit standing.

3. Decoding the Credit Score Range

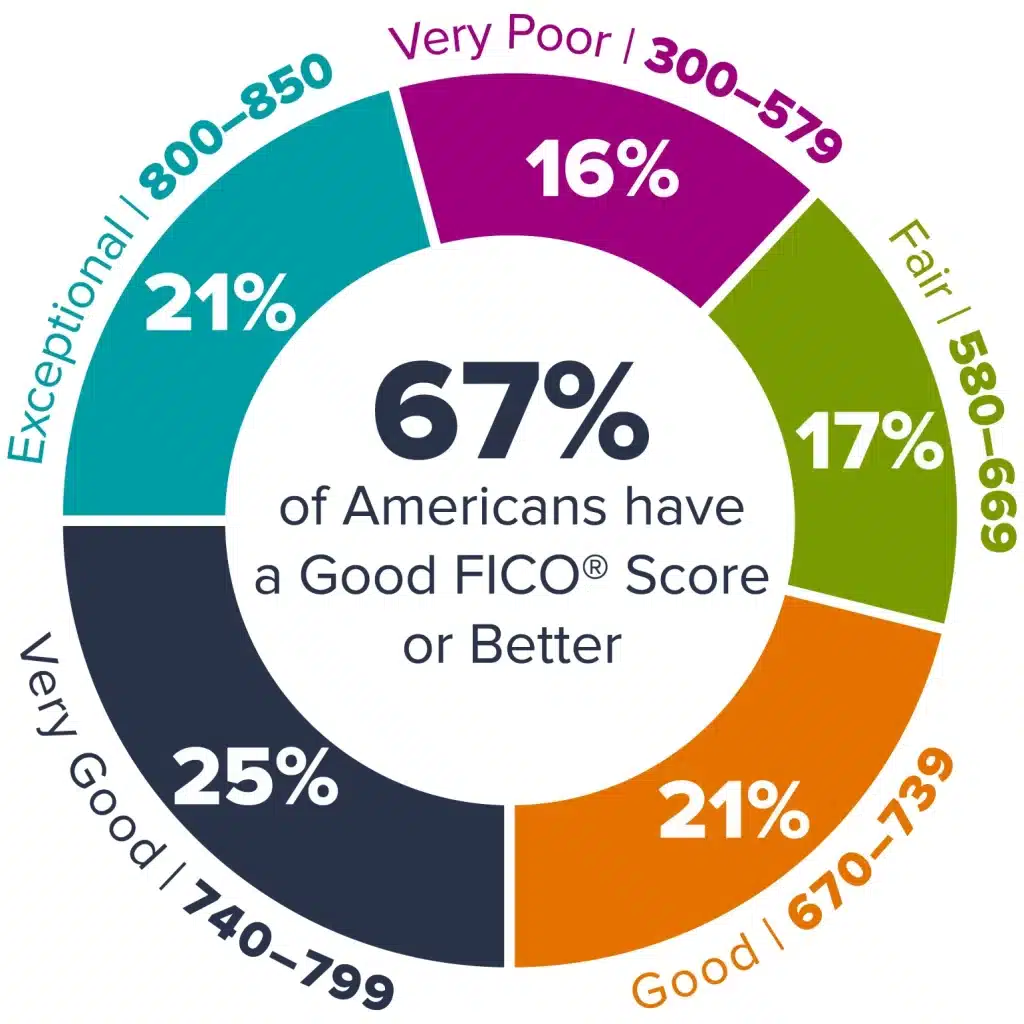

Credit scores typically range from 300 to 850. Each range signifies a different level of creditworthiness:

- 300-579: Poor credit. This range indicates significant risk.

- 580-669: Fair credit. It shows an average risk.

- 670-739: Good credit. This range is considered above average.

- 740-799: Very good credit. It indicates a lower-than-average risk.

- 800-850: Excellent credit. This score range signifies the lowest risk.

4. Factors Influencing Credit Scores

Understanding the factors that influence credit scores is essential for maintaining or improving them. Here’s a breakdown:

- Payment History (35%): Timely payments positively impact the score, while late payments, bankruptcies, and defaults have a negative effect.

- Credit Utilization (30%): This is the ratio of your credit card balances to their limits. Lower utilization rates are better for credit scores.

- Length of Credit History (15%): Longer credit histories generally lead to higher scores, as they provide more data on spending habits and repayment behavior.

- New Credit (10%): Opening several new credit accounts in a short period can be perceived as a higher risk, potentially lowering the score.

- Credit Mix (10%): A diverse mix of credit types, such as credit cards, mortgage loans, and personal loans, can positively influence a score.

5. The Impact of Credit Scores on Consumers

Credit scores can significantly impact an individual’s financial life. A high score can lead to better interest rates on loans and credit cards, which translates to lower payments and significant savings over time. Conversely, a low score can result in higher interest rates and even loan denials, affecting one’s ability to purchase a home, finance a car, or even secure employment in some cases.

6. Strategies for Improving Credit Scores

Improving a credit score is a journey, not a sprint. Here are some effective strategies:

- Regularly Pay Bills On Time: This is the most straightforward way to positively impact your credit score.

- Keep Credit Utilizations Low: Aim to use less than 30% of your credit limit.

- Monitor Your Credit Report: Regularly checking your credit report can help you identify and dispute any inaccuracies.

- Limit New Credit Applications: Only apply for new credit when necessary, as frequent inquiries can hurt your score.

- Maintain a Healthy Credit Mix: Responsibly managing different types of credit can reflect positively on your score.